Ira Income Limits 2025 For Backdoor - Limits For Roth Ira Contributions 2025 Gnni Shauna, The maximum ira contribution limit for 2025 is $7,000 for most account holders and $8,000 for those aged 50 or older. In 2025, the total contribution limit across both traditional and roth iras is $6,500 for individuals. Ira Limits 2025 For Backdoor.Exe Alisa Belicia, Your personal roth ira contribution limit, or eligibility to. Learn why some retirement savers opt for a backdoor roth ira.

Limits For Roth Ira Contributions 2025 Gnni Shauna, The maximum ira contribution limit for 2025 is $7,000 for most account holders and $8,000 for those aged 50 or older. In 2025, the total contribution limit across both traditional and roth iras is $6,500 for individuals.

Here's how those contribution limits stack up for the 2025 and 2025 tax years.

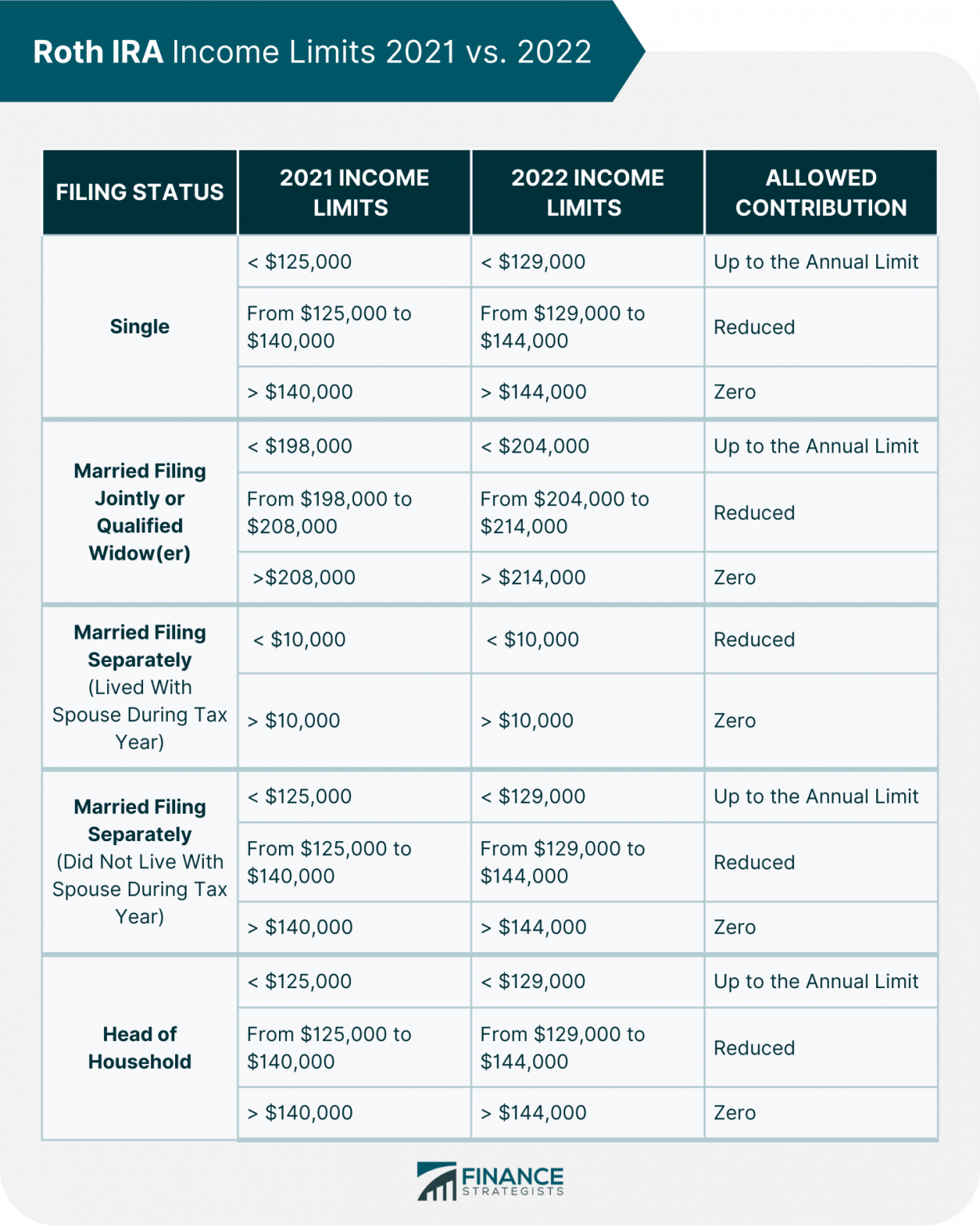

For 2025, the income limit for roth iras is $161,000 for single filers and $240,000 for married individuals filing jointly.

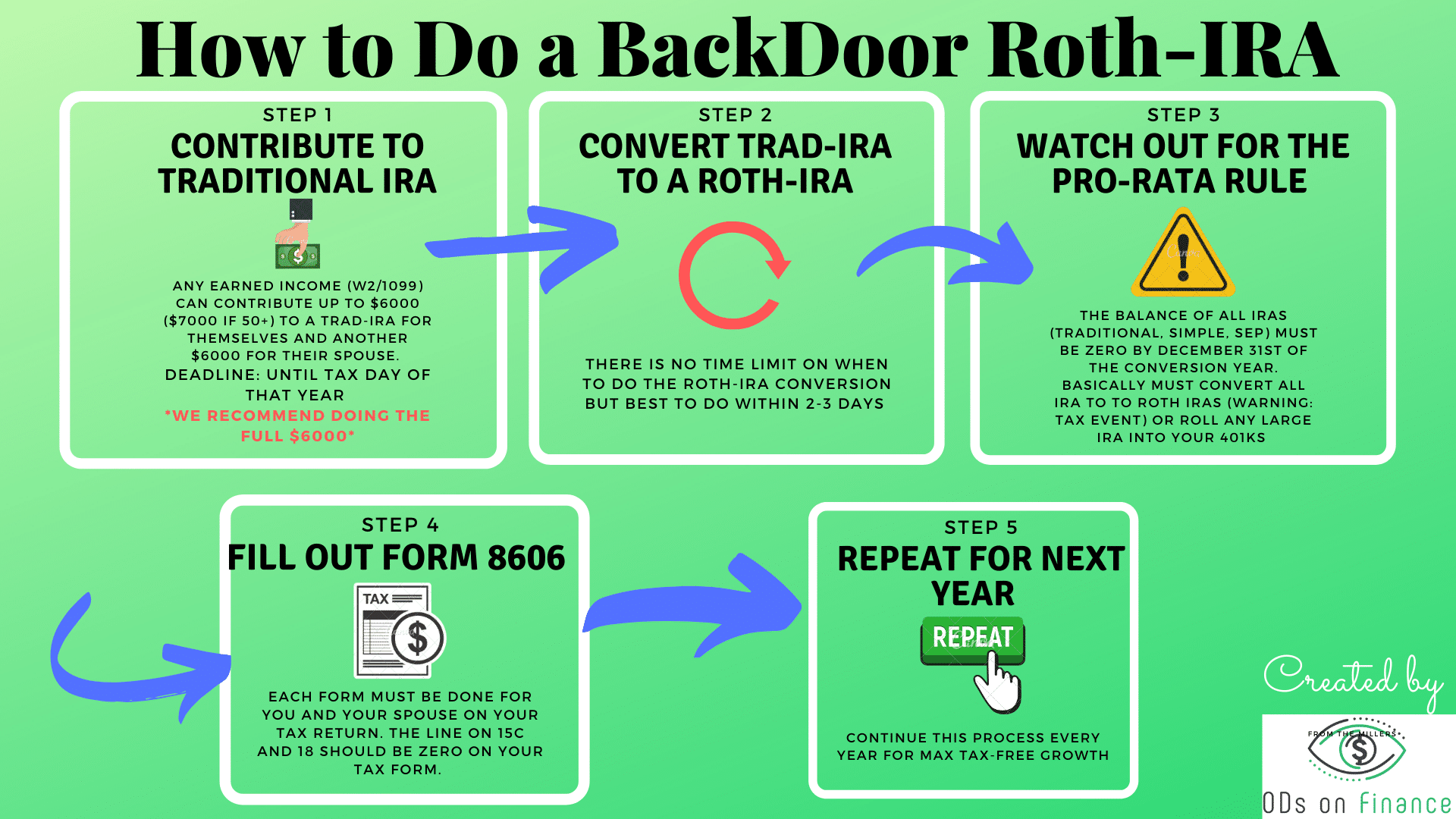

Ira Income Limits 2025 For Backdoor. How a backdoor roth ira works (and its drawbacks) high earners can get around income limits on roth ira contributions by converting other ira accounts to. For 2025, the income limit for roth iras is $161,000 for single filers and $240,000 for married individuals filing jointly.

Backdoor Roth Limits 2025 Junia Genvieve, A backdoor roth ira is a strategy for high earners to avoid the income limits of a standard roth ira and still benefit from its associated advantages. The contribution limit for individual retirement accounts (iras) for the 2025 tax year is $7,000.

2025 Limits For Traditional Ira Clair Demeter, There's a maximum combined contribution limit for roth and traditional iras of $7,000 in 2025 ($8,000 if age 50 or older). Should your client wish to open an ira.

Roth Ira Limits 2025 Phase Out Ibby Cecilla, How a backdoor roth ira works (and its drawbacks) high earners can get around income limits on roth ira contributions by converting other ira accounts to. A backdoor roth strategy is a way to bypass the income limits and contribute to a roth ira indirectly.

Backdoor Ira Contribution Limits 2025 Judie Marcela, Backdoor roth ira income limits. The roth ira contribution limits.

Should your client wish to open an ira. In 2025, you cannot contribute directly to a roth ira if you’re single with a modified adjusted gross income (magi) over $161,000 or married with a joint magi.

Backdoor Roth Contribution Limits 2025 Lois Sianna, Backdoor ira contribution limits 2025 judie marcela, the ira contribution limit. If you file taxes as a single person, your modified adjusted gross income (magi) must be under $153,000 for tax year 2025 and $161,000 for tax year 2025 to contribute to a roth.

Backdoor Roth Ira Contribution Limits 2025 Lizzy Margarete, The ira contribution limits for a particular year govern the amount that can be contributed to a traditional ira to. Back door roth ira strategy 2025.

Backdoor Roth Ira Limits 2025 Jenn Karlotta, Should your client wish to open an ira. Back door roth ira strategy 2025.

The contribution limit for individual retirement accounts (iras) for the 2025 tax year is $7,000.

Roth Ira Max 2025 Minda Sybilla, Retirement savers 50 and older may be eligible to contribute. In 2025, the total contribution limit across both traditional and roth iras is $6,500 for individuals.

Learn why some retirement savers opt for a backdoor roth ira.